‘Nightmare’ newbuilds test relationships to the max

BBC

BBCWhen you buy a new product, you expect it to be in working order, and when it isn’t you can just take it back. But for newbuild homeowners who have moved in to find a host of problems it has been far more difficult.

After nine people contacted the BBC to report issues with their properties built by Cala, one of the UK’s largest homebuilders, the sheer number of problems in one man’s house stood out.

Kevin and his family moved into their new home on April Fool’s Day 2020, something he says is ironic given his living room ceiling is still leaking four years later.

Kevin says problems with the house in the village of Mindenhurst, Surrey, started before they got the keys, when they were told by Cala Homes that safety balustrades would need to be installed across all the upstairs windows because the windowsills were too low.

“From the minute we walked in there was a glut of issues,” says Kevin.

“The front windows didn’t shut, the alarms didn’t arm, there was no power in the kitchen, the plumbing didn’t work and there was no hot or cold water in the showers.

“We’ve had the patio re-laid three times, the driveway re-laid twice… it’s just been a nightmare.”

Kevin says the house had a total of 184 problems including water leaks.

And that excludes the “snags”, the smaller defects that are common in newbuild properties and can number in the hundreds on their own.

‘The blind leading the blind’

Two independent chartered surveyors, Colin Bernhardt and Robin Austin, inspected Kevin’s home. Within an hour of arriving they agreed Cala Homes could have done an electronic test to quickly work out where Kevin’s ceiling leak was coming from, rather than their repeated, failed attempts to fix it.

Cala say they were advised by a roof “membrane manufacturer” that an electronic test would not be an appropriate way to establish the cause.

“This is a mastic joint, it allows the building to contract and expand,” Colin says as he pulls it out of brickwork on the roof. “It’s not doing anything.”

“These are all gaps where water can ingress,” Robin adds.

“I just think it’s the blind leading the blind in terms of what I’m seeing here.”

What protection do buyers have?

The National House Building Council (NHBC) is the UK’s leading provider of warranty and insurance for new-build homes, and offers buyers a 10-year warranty.

This insurance is split into two parts. The first two years covers the builder warranty period, in which the builder is responsible for rectifying problems arising from their failure to meet requirements.

After this, the NHBC insure homeowners against structural issues until the end of the 10 years.

Residents say this has made them feel they have no-one to turn to when the developer fails to fix issues in the first two years, as the NHBC tells them the company is responsible.

NHBC does offer a resolution service for such disputes, as long as buyers have completed the builder’s complaints procedure first.

Kevin says he approached the NHBC in September 2021, who told them to work with Cala as his dispute was within the two-year period.

“Given NHBC signed the property off I genuinely don’t trust they are independent and impartial in any way, hence we started our own legal action [against Cala].”

The issues with the home have been “really tough”, he says, and began at a particularly difficult time for the family,

“[We had a] new baby, three small children, Covid… We’ve had to go through counselling as a couple, this has really impacted our lives.

“The communication between the contractors and subcontractors has been poor. We have had to effectively project manage every issue from start to finish.

“We looked at selling 18 months ago… and the advice that we took was that we probably couldn’t sell this house at the moment, we’d lose too much money.”

When Michael Gove, the former housing secretary and MP for Surrey Heath, was invited to see Kevin’s property, he was so shocked by what he found he took photos of his own and “asked if he could send them directly [to Cala]”.

Cala Homes say that, subject to access restrictions caused by Covid, they have consistently attended to and resolved the issues Kevin has raised.

They also say they have agreed for more remediation work to be carried out this month.

‘Best if the house goes up in smoke’

Nick Mundy, 54, was due to move in to his home in Jordanhill Park in Glasgow in February 2022.

When he and his wife Karen visited just days before their moving-in date they say they found footprints on the walls and carpet and discovered low water pressure and missing units.

After they moved in, they say, professionals identified 285 snags in the home that varied in seriousness.

Cala Homes insisted the water pressure in the house was fine, Nick says, but further tests found it to be below requirements.

After a “six-month battle”, a water pump was installed, but even now the water pressure is still not what it should be, and takes half an hour to fill a bath and renders one shower unusable, according to Nick.

The couple were in the US when they got a phone call from Karen’s daughter telling them: “Cala has just broken the marble table in the kitchen.”

Contractors had come to fix loose flooring, and were “told to bring eight people” but “sent two and lifted it and managed to break the marble in half because of the weight,” Nick says.

“Every time they touch something, they make it worse.

“They came to fix scratches on the kitchen work counter, so they took the side leg off and managed to break everything, so they had to replace the entire island.

“When they put the island back in, they broke the hob so then they had to go get a new hob.”

Cala say they apologised for the accidental damage to Nick’s table and reimbursed him in full.

Nick Mundy

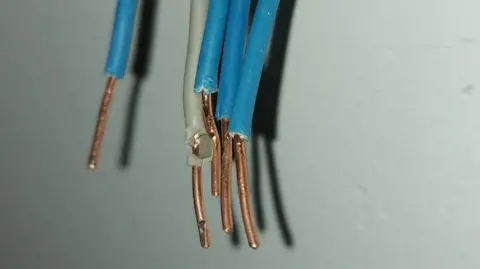

Nick MundyNick says other issues have included the wrong windows being installed twice, heat loss issues, and bare live wires hidden behind a wall.

The number of days that Cala said they would come to fix issues but then failed to turn up totals 45, he adds.

Cala say they have resolved the majority of items reported by Nick but have not been granted access to his home since January 2023 to allow the investigation of remaining items.

They say they offered to arrange for an independent surveyor to attend the home, which was agreed in April, but “the customer subsequently refused to commit to a date”.

After Nick arranged for professionals to inspect the property’s fireblocking (materials used to prevent fire spreading) he says they couldn’t guarantee that someone on the top floor would be able to get out of the house alive in a fire.

“The greatest thing to happen to me would be if this house went up in smoke,” Nick says.

“I wouldn’t have to deal with it… it’s just a nightmare.”

Cala Homes says there is no requirement to provide fireblocking around pipework with a diameter of fewer than 40mm in Scotland, that they never received a fire safety report from Nick and had not been granted access to assess the issue.

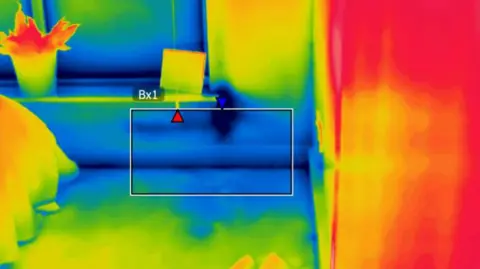

After receiving a thermal report from Nick that noted “fire doors and fire breaks require attention”, Cala says attempts were made to have them inspected despite them being compliant, but this “was not facilitated by the customer”, and no evidence was provided to support reports of air-flow issues.

It added that the water pressure issue on Nick’s development had been resolved by Scottish Water, but that they required access to his home to remove a temporary pump and allow the fix to take effect.

Nick Mundy

Nick MundyNick says: “I think there should be some form of hold back [of payment] when you close.

“So for example, if it’s a £100,000 home, let’s say £8,000 remains in escrow until all the snags are fixed, because once they’ve got your money they don’t care.”

In a statement, Cala Homes said: “We take real pride in the quality of our homes and customer service. On the rare occasions when things fall short of our high standards, we work with our customers to make it right.

“We are sorry for the experience these customers have had with their homes and understand their frustration. We have been, and remain, committed to resolving matters positively.”

An NHBC spokesperson said: “While we cannot comment on individual cases, we appreciate that a house is the biggest single investment many people will make and understand how frustrating it can be when things are not right.

“Whether NHBC is providing warranty or building control services, the builder still has primary responsibility to ensure the homes they are building meet building regulations.

“We inspect new homes at key stages of the build and this process is only finalised when we are satisfied, as far as practicable, that the builder has met our quality standards.”