UK borrowing costs at highest for a year after Budget

Getty Images

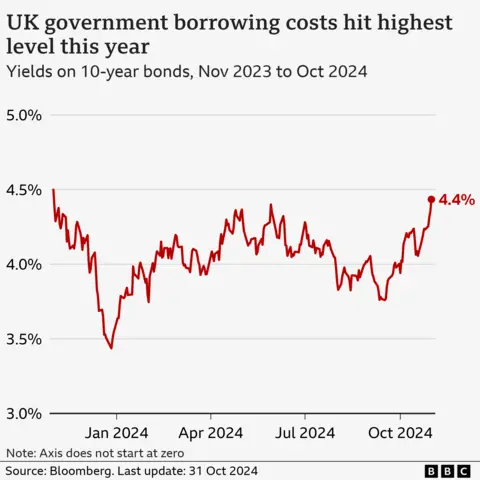

Getty ImagesThe cost of UK government borrowing has risen to its highest level for more than a year in the wake of Wednesday’s Budget.

The interest rate – the so-called yield – the government has to pay lenders when it borrows money from them over a 10-year period, climbed above 4.5% on Thursday before falling back.

Yields have been driven higher after the chancellor announced a sharp rise in government borrowing to finance spending projects, sparking expectations that interest rates will fall more slowly.

This matters because not only does it mean the government will have to pay more to borrow, but bond yields are also used as a guide for setting the rates on everyday loans and mortgages.

Downing Street has said it does not comment on market movements but insisted “stability is at the heart” of the chancellor’s new fiscal rules.

The rise is partly a response to Chancellor Rachel Reeves’ decision to significantly increase borrowing, but the BBC’s economics editor Faisal Islam says so far it is a natural market adjustment rather than the panicked reaction which followed Liz Truss’s mini-Budget two years ago.

There has also been a wider rise in borrowing costs over the past month, but that has been a global movement led by the US, he adds.

In the Budget, Reeves announced nearly £70bn of extra spending a year, funded by tax increases for business and extra borrowing.

Analysts said the upwards movement in bond yields was an indication that the markets weren’t happy about the increase in government spending.

Kathleen Brooks, an analyst at trading firm XTB, said the movement indicated that the Budget “has not been well received” by markets.

“This is another sign that the chancellor overestimated the market’s desire to absorb more sovereign debt issuance from the UK,” she said.

Susannah Streeter, head of money and markets at Hargreaves Lansdown, said expectations for interest rate cuts had been scaled back, given forecasts that the Budget could push up inflation over the next two years.

“Financial markets are now not expecting rates to fall below 4% until 2026,” she said.

“This has been reflected in the spike in UK gilt yields to some extent, but given that sterling has remained lower against the dollar, it also indicates that there is a growing nervousness about the way Labour is steering the economy.”

She said bond yields were set to stay “volatile” as institutions financing government borrowing “keep a more suspicious eye trained on what the swollen investment budget will be spent on”.

Prime Minister Sir Keir Starmer’s spokesperson said the Budget was “first and foremost” about “restoring fiscal stability”.

“It is a matter of government policy not to comment on market fluctuations,” she said.

However, she said there were no second thoughts over the amount the government was borrowing.

“We have seen reaction from bodies such as the IMF welcoming this approach.”